NCInnovation Secures Investment Manager for Endowment

By Linda Hall, Chief Financial Officer

Last week marked an exciting milestone for NCInnovation. After a diligent selection process, the NCInnovation Board of Directors voted to entrust Wells Fargo to manage the NCInnovation endowment. This decision reflects our commitment to ensuring the endowment fuels groundbreaking research at North Carolina’s public universities well into the future.

North Carolina state law directs NCInnovation to “contract with an independent investment manager to manage and invest the endowment for the purpose of generating investment income.” This investment income is what funds NCInnovation’s support for the remarkable innovation happening at North Carolina’s public universities.

In choosing Wells Fargo, we’re confident we have selected a partner with expertise and vision to steward the endowment responsibly and deliver the returns that will support North Carolina’s worldclass innovators for years to come. The company has a significant presence in, and commitment to, North Carolina, employing 33,000 people statewide and playing an active role in the state’s growth and prosperity.

The Board’s approval of Wells Fargo comes after a year-long competitive bid process overseen by the Board’s Investment Committee, with assistance from independent advisor ClearView Fiduciary Alliance.

Why This Matters

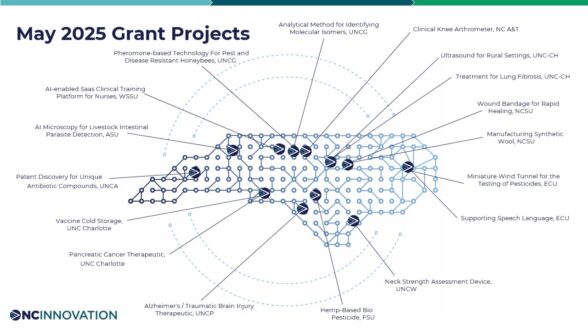

NCInnovation provides grant funding and support to accelerate the transition of promising discoveries from academia to industry. For decades, this university-to-industry pipeline has been a differentiator and competitive advantage for America’s technological might.

The funding for NCInnovation’s programs comes from the NCInnovation endowment. The original $500 million in state funding for the endowment earns interest and investment income, a bit like a retirement account or pension fund. It’s this “new” investment income that NCInnovation uses for its research programs. This innovative model, conceived by the legislature, eliminates the need for recurring state appropriations, ensuring sustainable support for advancing research and development that has the potential to change lives and drive economic growth.

Here’s one example of the idea working: Even though NCInnovation has already distributed several million dollars in research grant funding, the endowment still has more money than it started with.

The Investment Manager Selection Process

Selecting an investment manager for an endowment of this magnitude is no small task. Over the past year, our Board’s Investment Committee, with the help of independent advisor ClearView Fiduciary Alliance, conducted a rigorous and thorough search process.

Initially, 17 firms responded to NCInnovation’s public request for proposals.

The Board of Directors’ Investment Committee instructed ClearView to narrow the field according to objective criteria. Firms that did not meet the criteria, like a minimum amount of funds under management or a maximum service fee, were eliminated.

Each member of the Investment Committee independently reviewed and scored the remaining eight proposals according to six criteria, including portfolio implementation approach and experience with comparable clients. The four highest-scoring proposals advanced to the final round.

The Investment Committee interviewed each of the four final firms, then discussed their qualifications. The Investment Committee decided that Wells Fargo was the strongest bidder on the totality of the weighted criteria as established early in the process, and based on ClearView’s extensive experience advising clients. The Investment Committee then recommended Wells Fargo to the Board, which voted in support of the recommendation.

Looking Ahead

In its proposal and interview, Wells Fargo demonstrated the experience and expertise necessary to strategically position NCInnovation’s endowment with a conservative investment approach, while allowing for flexibility to adapt the portfolio as NCInnovation’s position evolves. In addition, Wells Fargo has a dedicated practice for providing investment services to philanthropic clients, managing over $24 billion in assets for such organizations.

Wells Fargo’s approach aligns with NCInnovation’s vision for the future: steady, sustainable growth that maximizes our ability to support the groundbreaking work of North Carolina’s public universities. We remain excited to see the incredible discoveries and solutions that the NCInnovation endowment will help bring to life in the years to come.

NCInnovation, Inc. is a Research Triangle Park, NC-based 501(c)(3) public-private partnership designed to accelerate commercialized innovation from North Carolina’s research universities. Backed by more than $25 million in private philanthropic commitments, NCInnovation uses the interest and income from a $500 million State-funded endowment to provide non-dilutive grant funding, mentors, and support services so that North Carolina university proofs-of-concept return value to the regional communities that created them. Learn more at NCInnovation.org.